For most of the past decade, it has been hard to find higher-yielding opportunities in the real estate investment trust ("REIT") sector (VNQ).

Interest rates were low, market sentiment was high, and most REITs would trade at yield 2-3% dividend yields.

But this has now changed.

Suddenly, REITs are now hated by the market, and there are plenty of "respectable" REITs that offer yields of around 6%.

Yields are now so high because REITs have kept hiking their dividends even as share prices collapsed. The combination of rising dividends and declining share price results in higher yields:

We think that this is an opportunity.

As we have explained in previous articles, investors are missing the forest for the trees. They are fixating on rising interest rates and panicking over them, not understanding that their impact on most REITs is not that significant. REITs use little debt, and most of this debt is fixed rate and has long maturities. Besides, interest rates are only rising because of inflation, which leads to rising rents and property replacement costs.

This explains why REITs have kept growing their cash flow and dividend payments in 2022 at a rapid pace. It also explains why REITs have historically outperformed and generated high total returns during past periods of rising interest rates:

Therefore, we think that this sell-off is a market anomaly that will be soon followed by a rapid recovery. Now, you still have the chance to accumulate these REITs while they are offered at high yields, and that's what we are doing at High Yield Landlord.

Below, we highlight two REITs that offer a ~6% dividend yield that we are buying for our Core Portfolio:

Clipper Realty Inc. (CLPR)

Historically, apartment REITs have been some of the lowest-yielding REITs in the market. This is because apartment communities are perceived to be some of the safest investments in commercial real estate and, therefore, they trade at relatively low cap rates.

Clipper Realty is the exception. It now yields nearly 6% following its recent drop, and given how rapidly its cash flow is now rising, it wouldn't surprise us if a dividend hike would soon put it above a 6% yield.

But it is not discounted just relative to its dividend, but also relative to its cash flow and asset values. Right now, CLPR trades at just 15x FFO and an estimated 40% discount to its net asset value.

Why is it so cheap?

Well, there are two main reasons.

Firstly, the entire apartment REIT property sector is today out-of-favor, and all apartment REITs, including AvalonBay (AVB), Mid-America (MAA), and Independence Realty (IRT), are currently discounted. Investors fear that the housing market may be about to collapse and that this could have a contagion effect on the apartment rental markets, causing rents to drop.

This narrative is wrong, of course. What investors appear to ignore is that housing unaffordability is a major tailwind for apartment landlords. The rising interest rates only make apartments more appealing, since renting becomes more affordable, relatively speaking, and it gives landlords more bargaining power to hike rents, not decrease them. Also, as increasingly many people feel that now is too risky to buy a home, the pool of renters grows, which again, leads to rising rents in apartment communities. CLPR has been pushing double-digit rent hikes throughout 2022.

Secondly, CLPR is particularly depressed because it focuses on NYC, which is today even more out-of-favor than the rest of the country. It suffered more from the pandemic, people still haven't all returned to offices, and the market fears that the return may never fully happen, impacting local landlords. Moreover, NYC has historically been more cyclical than many other markets, and we appear to be approaching a recession.

But again, this narrative does not apply very well to CLPR. It may apply to NYC office REITs like SL Green (SLG), but it applies poorly to an apartment REIT like CLPR, because even if people don't fully return to offices, they will still want to live in NYC. If you only have to spend 2-3 days a week at the office, it may impact the office sector, but it won't change your need for an apartment. Moreover, CLPR focuses mainly on affordable, Class B communities that are more recession-resistant than average, and its rents are currently below market, providing further margin of safety.

For these reasons, we think that the market has overreacted. It makes little sense for CLPR to trade at just half of its asset's value, and the management appears to be getting increasingly frustrated as it recently put its biggest asset on the market for sale. Perhaps, they are trying to prove to the market that they are undervalued by selling one of their assets and using the proceeds to pay off debt and buy back stock.

While we wait for the upside, we earn a generous ~6% dividend yield. A return to NAV would lead to no less than 100% upside.

Essential Properties Realty Trust, Inc. (EPRT)

As STORE Capital (STOR) got bought out, we recently redeployed the proceeds into Essential Properties Realty Trust.

Both companies are very similar in that they are triple net lease REITs that focus on middle-market companies.

It is a great business model because it results in above-average cash flow that's highly consistent and predictable.

EPRT is able to buy assets at a >7% cap rate with 15+ year leases, no landlord responsibilities (tenants pay all property expenses), and steady annual rent escalations that are pre-agreed in the lease.

The properties are mainly single-tenant, service-oriented retail properties like McDonald's (MCD) restaurants, Exxon (XOM) gas stations, or Walgreens (WBA) pharmacies:

Therefore, the cash flow is highly resilient to recessions because leases are long and the rent is pre-agreed for their entire duration. In fact, the biggest net lease REITs, Realty Income (O) and National Retail (NNN), have both been able to grow their dividends through past crises, including 2000, 2008, and 2020.

You would expect such a defensive business to experience lower volatility, but against all odds, EPRT is down just as heavily as the rest of the market:

We suspect that it is down so much because of two main reasons:

Firstly, the market fears that inflation will hurt its business since its leases only have 1.5% annual rent escalations, which limits its ability to pass rent hikes on to its clients. But what the market appears to have overlooked is that this is only a small component of EPRT's strategy to grow. It also grows by retaining a lot of cash flow, raising new capital, and selling properties at lower cap rates to buy new ones at a positive spread. This is how EPRT is able to grow at a rate that actually surpasses inflation:

Besides, EPRT is not responsible for any property expenses so it enjoys superior protection against inflation on the cost side, and the high inflation also won't last forever.

Secondly, the market appears to be concerned about the potential impact of rising interest rates on EPRT. But again, these fears appear to be overblown, especially in the case of EPRT because it has the strongest balance sheet in the net lease sector. Its LTV is just 20% and its maturities are long. Therefore, the impact of rising rates won't be material:

We believe that the market has simply overreacted and that EPRT is now discounted. Temporarily, you can now buy the REIT at a near 6% dividend yield, and as it recovers to its 2021 levels, it also has 50% upside potential.

The upside is now potentially as much as that of CLPR, but EPRT is also a lot safer and expected to grow at a faster rate in the long run.

Bottom Line

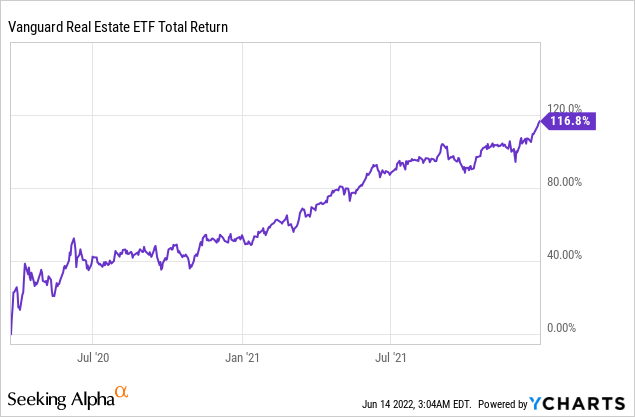

REITs are now temporarily discounted, and many of them offer high dividend yields. The last time REITs were so cheap was in the aftermath of the pandemic, and they then more than doubled in value in the following year as the market realized that it had made a mistake:

We expect similar large upside in the coming years as the market recovers. We will earn high dividend payments while we wait.

High Yield Landlord, #1 Service for Real Estate Investors and Retirees

High Yield Landlord recently broke the 2500-member mark! Our prices will increase soon but all members who sign up now are grandfathered for life at today's discounted rate!

If you are still sitting on the sidelines… now is your time to act. Start your 2-week free trial TODAY and lock in this discounted rate before we hike it!

Want A 50% Discount?

Start Your Free Trial Today

We have over 500 five-star reviews from members who are already profiting from our 8% yielding portfolio.