Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations.

As the Federal Reserve has continued hiking interest rates, mortgage rates and interest rates on credit cards have also been on the rise. But what about the interest rates on certificates of deposit (CDs)?

They have gone up, too, but forecasters say savers should keep their expectations in check.

Here’s an overview of where CD interest rates are now and where they could be headed in 2024 and beyond.

FEATURED PARTNER OFFER

U.S. Bank Certificate Of Deposit (Special)

On U.S. Bank's Website

Member FDIC

Rates as of 1/04/2024

Get up to 5.05% APY*

$1,000

*Offer Details

Earn more on your tax refund or annual bonus with competitive CD rates. Start saving today.

Grow your money with a Certificate of Deposit account at U.S. Bank. Now, get a higher rate of return by locking in an exclusive rate on balances up to $250,000:

- Up to 4.40% Annual Percentage Yield (APY) for 7 months

- Up to 5.05%% Annual Percentage Yield (APY) for 9 months

- Up to 4.30% Annual Percentage Yield (APY) for 11 months

- Up to 4.20% Annual Percentage Yield (APY) for 15 months

Member FDIC

Rates vary by state and zip code. Please click here to see your rate before applying.

Are CD Rates Going Up?

CD rates may be flattening out. In July 2023, the Federal Open Market Committee (FOMC) again raised the federal funds rate, this time to a range spanning from 5.25% to 5.50%. In all of its meetings since then, however, the Fed decided to maintain the current target range for the federal funds rate. While the Fed is actively monitoring inflation, further rate increases seem unlikely.

Banks generally use the federal funds rate as a guide when setting rates on savings and lending products. As the federal funds rate increases, you can expect CD rates at many banks to follow suit, and vice-versa.

Recent bank failures have many consumers worried about whether funds kept in CDs are as safe as claimed. The good news is that your bank deposits are FDIC-insured up to $250,000 per depositor, per account ownership type and per financial institution. Some banks have raised rates during this period of uncertainty to incentivize existing customers and attract new ones.

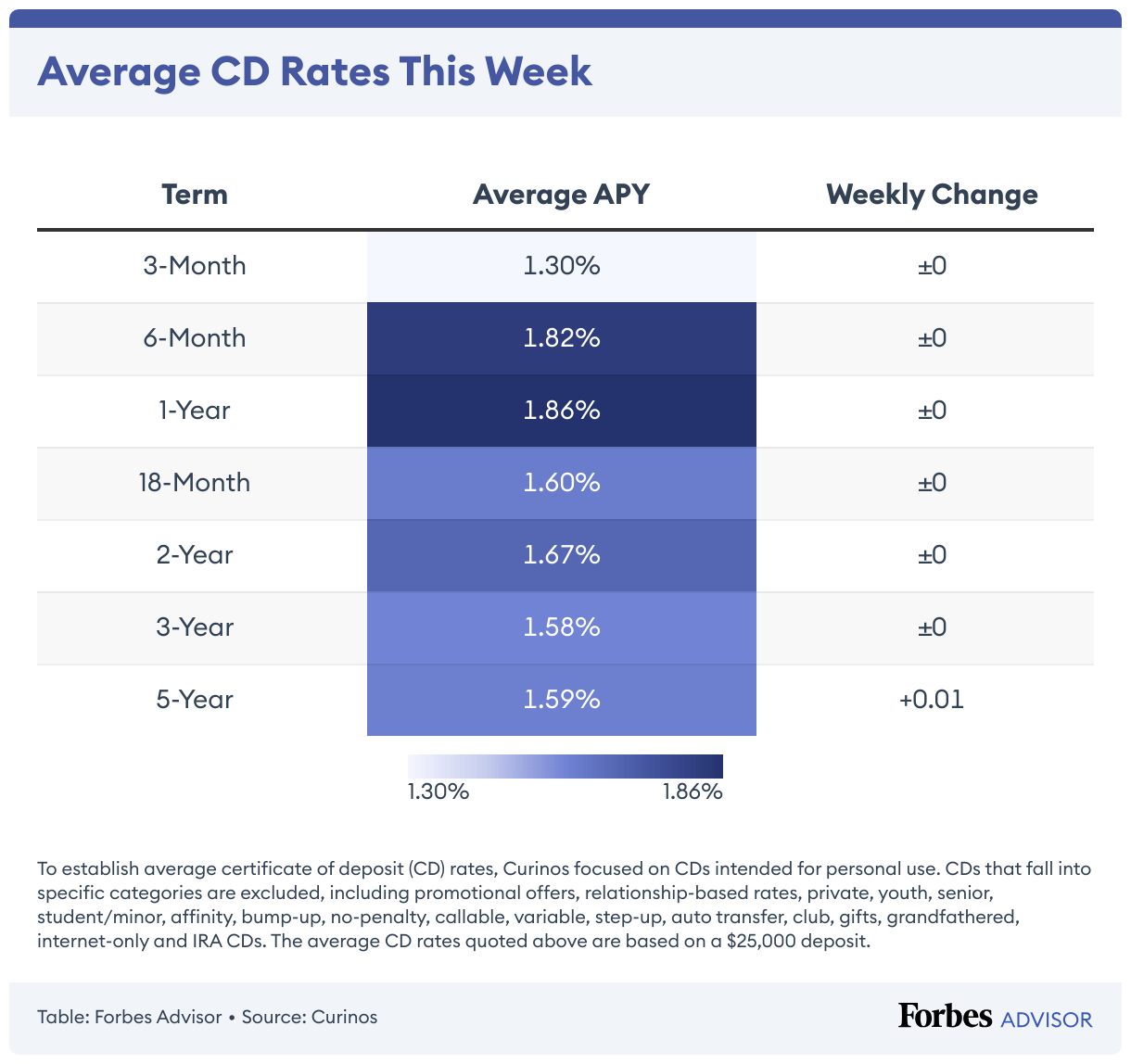

In January 2022, the typical APY, or annual percentage yield, for a one-year CD sat at a mere 0.13%—a pandemic low, according to FDIC data. As of February 2024, average one-year CD rates are at 1.83%.

Other CD terms saw similar increases during the same time frame, including two-year CDs and five-year CDs. The average rate for the former increased from 0.17% to 1.54% and from 0.28% to 1.40% for the latter.

While the current averages may not sound very impressive, the best CD rates now surpass 5.00% APY for one-year CDs and 4.50% APY for two-year CDs and five-year CDs.

CD Rates Forecast 2024

It’s difficult to predict exactly what CD rates will look like in 2024. While the federal funds rate had been steadily climbing for a couple of years, the CME FedWatch Tool, which measures market expectations for the fed fund rate changes, shows that most expect rates to fall between 4% and 4.75% by the end of 2024.

At its January 2024 meeting, the FOMC held the federal funds rate steady at a target range of 5.25% and 5.50%, stating that inflation is still too high. While rate cuts are expected to occur at some point this year, the Fed didn’t clarify when they might happen.

We believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

—Jerome Powell, Federal Open Market Committee meeting press conference, Jan. 30-31, 2023

Just as banks have raised CD rates with federal fund rates increases, you could see rates drop if and when the federal funds rate decreases. But as indicated in FOMC’s statement, controlling inflation is still a priority, and it’s unlikely that rates will decrease at its next meeting in March.

CD Rate Trends from 2022 through 2024

While there are no guarantees concerning how interest rates will move in the coming months, here are two predictions for CD rates moving into 2024.

Banks’ Motives Dictate Rates for CDs

Banks will do what’s best for their bottom lines, and having a gap between mortgage rates and CD rates increases profit. As the inflation rate cools from its 2022 highs, mortgage rates and CD rates are likely to fall as well, but at different paces.

While mortgage rates increased by over three percentage points in 2022, average CD rates only went up by around 2%. For now, banks will likely increase mortgage rates at a quicker pace than CD rates to maintain profit margins.

Treasury Bonds Will Pay More Than CDs

CD rates may be flattening, but if Treasury yields go down in 2024, CD rates could follow—regardless of what the federal funds rate does. Banks are often slow to adjust CD rates, which means the rates you find at your bank may pale in comparison to Treasury yields. There’s an incentive for banks to keep rates on savings products lower: Banks use CDs and other deposits to fund loans and investments in Treasurys, so the lower the rate they pay, the more they profit.

CD Rates From 2009 to 2023

The graph below uses historical FDIC data to display national average rates on CDs from 2009 to 2023 and highlights how CD rates responded to changes in central bank policies, inflation rates and broader economic indicators over the analyzed time span. Rates have been averaged for each year using data available from every month.

Source: FDIC National Rates and Rate Caps

In the years after the 2008 financial crisis, the country entered the worst economic downturn since the Great Depression. During this period, the Fed aggressively slashed interest rates to stimulate the economy and restore liquidity to the banking system. As economic conditions improved in the subsequent years, CD rates adjusted accordingly, stabilizing and eventually creeping upward.

In 2019, The Fed cut interest rates again in response to the economic slowdown caused by the U.S.-China trade war.

The year 2020 brought an unprecedented global pandemic that caught the world off guard. Within weeks, this virus spread around the globe and led to severe economic consequences. In the United States, roughly 20.5 million people lost their jobs in April 2020, and the unemployment rate jumped to 14.7%.

In an effort to support the economy, the FOMC dropped the federal funds target rate to a range of zero to 0.25%. However, as the economy bounced back shortly after, so did inflation. The strained supply lines due to Covid-19—paired with an increase in demand—caused prices to surge, and the FOMC had no choice but to implement consecutive rate hikes. CD rates responded accordingly and jumped drastically from 2021 to 2023.

Factors That Influence CD Rates

Just like mortgage rates, savings rates and credit card interest rates, CD rates correlate strongly with the federal funds rate. When the Federal Reserve increases its benchmark rate, interest rates across the economy, including CD rates, increase. Similarly, decreases in the federal funds rate cause CD rates to fall.

Part of the draw of opening a CD is that its earnings are guaranteed regardless of economic environment changes. If you lock in an interest rate by purchasing a CD, you’ll be paid that guaranteed rate for the entire term of the CD.

At the beginning of 2023, many Americans believed we were headed for a recession, but current opinions among economic pundits are decidedly mixed. The Federal Reserve typically reacts to recessions by reducing interest rates to trigger an increase in consumer and business spending.

The Federal Open Market Committee recently stated that it’ll keep the federal funds rate steady in the near future. If the economy falls into a recession, though, and the Federal Reserve reverses course and starts cutting interest rates, CD rates are likely to fall. However, its instinct to lower rates could be tempered by its desire to combat inflation.

Do CD rates go up with inflation?

Yes, CD rates typically rise with inflation but not directly because of inflation. Rather, the Federal Reserve increases the federal funds rate to combat inflation. And because interest rates throughout the economy are tied to the federal funds rate, when the Federal Reserve increases its benchmark rate, CD rates generally increase.

Do CD rates go up with the prime rate?

The prime rate is a benchmark widely used by banks when setting interest rates. Returns on savings accounts, interest-bearing checking accounts and CDs typically track the prime rate, which in turn tracks the federal funds rate. When the prime rate goes up, you can expect CD rates to rise.

Do CD rates go up during a recession?

Historical data suggests that CD rates track the federal funds rate, which has held true during past recessions. Typically, the Federal Reserve will lower interest rates during a recession to spur growth and reduce unemployment. Because CD rates follow the federal funds rate, CD rates will usually go down during a recession.

Will CD rates go up when the Fed raises interest rates?

Yes, like other deposit accounts, CD rates tend to rise whenever the federal funds rate increases. Banks and credit unions use the federal funds rate as a guide when setting rates on deposit products like CDs.

How To Maximize the Benefits of Current CD Rates

With CD rates elevated, now is the time to take advantage of savings opportunities. Below are some tips to maximize savings benefits with CDs.

- Shop around. Compare CDs at several banks and credit unions to find the highest rates. CDs have fixed rates, which means guaranteed returns based on the rate, account balance and term length. Securing the highest rate will help you earn the most interest over the course of the CD term.

- Choose the best CD term. Consider how long you can keep available funds tied up in the bank when deciding which term length to choose. The last thing you want is to choose a term that is too long and end up having to withdraw funds early and pay a penalty. Also, keep your eye open for banks with higher promotional CD rates on specific terms.

- Create a CD ladder. Increase your savings while maintaining some flexibility by creating a CD ladder. This strategy involves opening several CDs with different term lengths. When a CD reaches maturity, reinvest the funds into a new CD. CD ladders keep some money accessible in case you need it. Remember to shop CD rates each time you open a new CD to lock in the best rates.

Find The Best CD Rates Of 2024

Learn More

Where To Find the Best CD Rates

If CD rates continue to increase in the coming months, it might be a good time to shop around for the best CD rates, especially if you have funds you won’t need access to right away.

Typically, you’ll find higher CD rates offered by online banks or credit unions. Online banks don’t carry the same overhead costs as operating bank branches, so they often charge fewer fees and offer higher rates.

Pro Tip

Credit unions are nonprofit organizations, so they’re also more likely to offer competitive CD rates that respond quickly to Fed rate changes.

Frequently Asked Questions (FAQs)

Will CD rates go up in 2024?

Not likely. Many experts agree there’s a good chance CD rates have topped out for now, and rate cuts may take place later on in 2024.

When will CD rates go up?

Pro Tip

Banks typically move much more quickly to charge higher interest rates on loans and credit than they do to pay higher interest on savings. So, while mortgage rates have been soaring, CD rates are only inching up.

How various interest rates—including those on CDs—move during the coming months will depend greatly on what the Federal Reserve does. The Fed boosted its benchmark federal funds rate numerous times throughout 2022 and the first half of 2023, finally holding rates steady at a target range of 5.25% to 5.50% through the second half of 2023. Rates may eventually begin to decline in 2024.

The federal funds rate is what banks charge each other for overnight loans, and changes in the rate affect borrowing costs for various financial products.

When the federal funds rate rises, interest rates normally rise on mortgages, credit cards, CDs and other loan and deposit products.

How much money should I have in CDs?

The amount of money you should keep in a CD depends on your financial situation and goals, and there’s no perfect number you should aim for. Instead, look at CDs as one piece of your overall investment strategy.

Keep in mind that CDs aren’t a great option for emergency savings because you’ll often pay penalties for withdrawals prior to a CD’s maturity. CDs also aren’t a good long-term investment option because returns on CDs are generally lower than returns on investments. In any case, you’ll need to deposit enough funds to meet the CD’s minimum opening deposit requirement.

Should I invest in a CD?

CDs offer guaranteed returns and are federally insured. If you have funds available to invest that you won’t need right away, CDs are an excellent way to build up your savings. It’s a good idea to have a fully-funded emergency fund in place so you don’t have to withdraw money from a CD before it reaches maturity.

If you decide to open a CD, consider future financial needs, how much money you can afford to keep locked up in a CD account, and for how long.

If you’re unsure if you can part ways with your cash long-term, you might be better off looking for the best high-yield savings accounts, which may offer rates comparable to CD rates.