- Home

- Bookkeeping Terms

- Commission Income

Commission income is an amount earned in exchange for transacting a sale of a product or providing a service.

Page Contents:

What is Commission IncomeAffiliate Commission ExampleCommission Calculations and Excel CalculatorRecording Commissions in Bookkeeping

What Does Commission Mean?

The word commission has several meanings, but in bookkeeping accounting, commission means a fee that a person or business receives or pays out when a business transaction is completed.

what is commission income?

Commission income is usually a percentage of sale proceeds, but it could also be a flat rate depending on the sales commission agreement between the owner of a product and the seller of that product.

The owner of a product will decide if they are willing to pay people a commission to sell their product and how much of the income they are prepared to pay to the seller whilst still making a profit.

The product owner might agree that the seller can earn a percentage, or the owner might specify a dollar value.

Even though sharing the earnings means the owner will get less money from each product, they may actually earn more money overall because now lots of different people are going out of their way to sell products for them.

The benefit to the owner:

- Make more income by selling more of the product through many different sellers (affiliates) or through experienced agents or sales reps, who know how to sell a specialized product.

The benefit to the seller (affiliate, agent):

- sell as many products as they can to earn a portion of the income (the commission); and the more products they sell, the more portion of income they themselves will earn.

Salary vs Commission

The owner of a product can also be referred to as an employer if they hire a sales representative as an employee and pays them commission income on top of a salary.

The sales rep. must go out and get customers to buy the product and then the business owner pays them a commission out of the sale.

A salary is a fixed amount the employer must pay the employed sales representative regardless of whether the sales rep. manages to sell anything or not.

Types of Commission Income

Here are some popular types of business transactions on which commission income can be earned:

Real Estate Property

Property agents earn commission income on the properties they sell. The property owner pays a commission to the property agent when the property is sold.

Education Courses

Online education courses have exploded over the last few years making it cheaper and more convenient for people to learn what they want. Sellers of online courses can earn good commission income.

Art

Galleries can earn commission income by selling work of artists.

Affiliate Programs

Affiliate programs are very popular for making commission income online from almost any product you can think of or from many different types of services. Many product makers have their own affiliate programs or can put their products on a platform like Amazon or Etsy. Here is an example:

example of affiliate commission income

Daniel is a motivational speaker. He has written a book. He promotes the book as much as he can through his website and speaking engagements.

Through his own efforts in 1 month he manages to sell 500 copies at $20 each earning a total of $10,000.

The next month he decides to let other people promote and sell his book for him through what’s called an affiliate program (one example of this is eBooks.com).

Daniel keeps the price of the book set at $20 and agrees to give each seller, called an “affiliate”, $2 from each book sold. He has 15 affiliates signed up selling his fantastic book.

With 15 different affiliates promoting his book on their websites and social media platforms throughout the world, Daniel’s book sales rocket up to 2,000 copies (not counting his own sales). That’s an income of $40,000.

Out of that, the commission income is distributed to Daniel’s affiliates, a total of $4,000. Each affiliate gets a commission based on the number of books they sold. So, the more books an affiliate can sell, the more commission they can earn over the other affiliates.

Daniel is now left with an income of $36,000. That’s $26,000 more than what he did on his own in the first month.

How to Calculate Commission

As mentioned earlier in this article, commissions are either percentage based, or value based.

Using the same figures from the Affiliate Example above here is the math for the calculation of commissions.

Fixed Value (Flat Rate) Commission Calculation

The commissions are $2 per book. 2,000 books were sold.

$2 x 2,000 = $4,000 Total Commission

Here is an example of the fixed value commission calculations for all affiliates.

The commission is calculated by multiplying the Qty Sold by the Commission Amount of $2.

So for Affiliate 1: $2 x 180 = $360

Percentage Commission Income Calculation

If Daniel had decided to pay a percentage of the sale value per book instead of the flat $2, here is how the math would look.

10% x $20 = $2 Commission per book

$2 x 2,000 = $4,000 Total Commission

This requires two steps to get to the dollar value.

Here is an example of the percentage commission calculations for all affiliates.

The commission income for each affiliate is calculated by multiplying the Total Sale Amount by 10%.

So for Affiliate 1: 10% x $3,600 = $360

other methods of calculating commission income

A product owner might provide a tiered method of calculating commissions to give the seller an incentive to sell more products.

Tiered Example

Sell 30 books get 10% per book.

Sell 60 books get 12% per book.

Sell over 100 books get 15% per book.

In this case, the Excel calculation sheet will require more advanced formulas to account for the different sale levels.

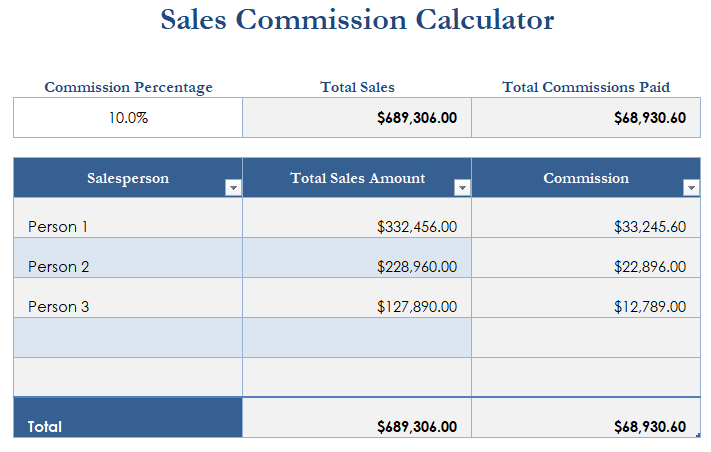

Commission Calculator

This calculator was taken from the Microsoft Excel Templates library and adjusted to get the affiliate examples on this page. The image below is a screenshot of their calculator before I changed it.

You can download my adjusted calculator here - this is the one I used for all the Affiliates in my prior examples on this page. This includes the setup for both fixed value and percentage based calculations.

Download Excel Calculator

Recording Commission Income In Bookkeeping Records

How to enter commission income in the bookkeeping accounting records of a small business.

Open an Income account and call it Commission Income (you can just call it Commissions if you know you don’t have an expense account of the same name). Commission Income goes onto the Income Statement, also called the Profit and Loss Report under Income.

There are two methods of entering commission income:

1. Cash method

When the commission payment is received into your bank account you will enter the payment to the Commission Income account.

Cash Method Journal Entry

Debit Bank account

Credit Commission Income account

2. Accrual method

The product owner may send you a Statement of your commissions before you receive the actual payment.

You can enter this as a sales invoice in your bookkeeping software.

The amount will be entered to the Commission Income account.

The invoice will remain as unpaid under your Accounts Receivable account on the Balance Sheet until such time as you receive the actual payment.

Once payment is received into your bank account, look for the invoice in your bookkeeping software and pay it.

Accrual Method Journal Entry

1. Sales Invoice

Debit Accounts Receivable account

Credit Commission Income account

2. Payment

Debit Bank Account

Credit Accounts Receivable account

There are some other technicalities around commission income which are covered in the question and answer section below.

commission Income questions

From real Business Bookkeepers/Owners

question 1: gallery accounting for selling artwork

I have a Gallery and am starting selling art work for other artists.

I am paid the full amount for the painting then I take my commission and pay the remainder to the artist.

How do I enter this and which amount will go against turnover?

Answer:

You are holding onto, and showing, the art piece and rather than buying it when it sells (like some galleries do) you are looking after the money from the customer until such time as you pay it to the artist minus your commission. In this case, the amount the artwork sold for is not your income. Only the commission is your income (turnover).

If you put the money received from the customer into your gallery's bank account, then in your bookkeeping records you should show this amount in a balance sheet liability account - call it Artists Funds or similar.

When you pay the artist and take commission:

- in your bookkeeping records the amount you pay the artist will come directly out of the Artists Funds balance sheet account

- you will move your commission portion from the Artists Funds to a profit and loss account called Commission Income – use a journal in your bookkeeping software to do this

If you were one of those galleries that buys the artwork from the artist when the gallery sells it, you would have to:

- declare the full sales price as your income* (on the P&L as sales income)

- and the price you buy it for from the artist would be a cost of sale - commission does not come into this scenario.

- the difference between your sale price and the cost of sale is where your earnings comes into it.

*Lawyers and real estate agents are required to hold on to their client's money in special Trust accounts, so the client's money stays protected. It is always a good idea to hold client money in a specialized separate bank account from your day to day checking account so you don’t spend that money on your own business.

Question 2:Accounting for Real Estate Commissions

We received a large commission off a real estate sale. We put some of the money in cash in a safe deposit box and some was deposited into our business checking account. How do I record these transactions?

Answer:

- In your bookkeeping software, open a new Asset account under your checking account on the Balance Sheet and call it Safe Deposit Box. This box is like a mini bank of its own so is treated like a bank account (except you're just dealing with cash).

- In your bookkeeping software, the original commission amount received can be split-deposited between the checking account and safe deposit box according to how much was deposited into each.

- Any cash moved between the checking account and safe deposit box just gets transferred in the bookkeeping software between the two accounts the same as if it was two bank accounts (like checking and savings).

Facebook Comments

Leave me a comment in the box below.

Share this page