These 10 responses to readers’ most common questions about debt provide four unique ways to tackle your debt

Questions about debt are some of the most often received here at PeerFinance101 – how to get out of debt, which debt should be paid off first, and generally how to manage debt.

Instead of rehashing some of my own responses or the tricks we’ve seen in PeerStories on the site, I thought I would reach out to the rest of the personal finance blogger community for their unique perspectives.

I’ve compiled responses from nine other bloggers below, sharing their most common questions about debt and their tips as well as a few of my own ideas. While many of the questions bloggers receive about debt are similar, their responses are unique and offer different ways to tackle the debt dilemma.

This post starts us off on a series we’ll be running over the next two weeks. We’ll also cover the most common questions in Saving & Budgeting and wrap it up with your questions on Investing & Making Money.

Most Common Questions on Getting Out of Debt

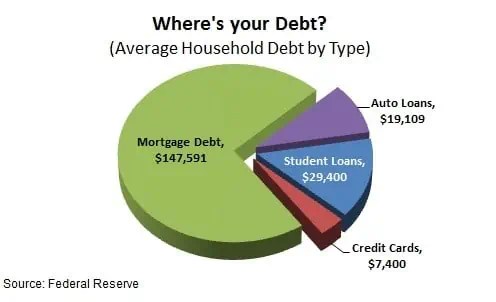

Answering your debt questions usually starts with the type of debt you have and how much of a burden is it on your budget. The Federal Reserve reports that the average American has over $7,000 in credit card debt followed by nearly $20k in auto loans.

Tracie Fobes, Penny Pinchin’ Mom

I get questions all the time about how to get out of debt. First of all, if you’re not willing to put in the hard work it takes to pay off debt then any plan is going to fail. From there, you need to first make a budget and find areas where you can cut back spending – and use those cuts to throw at your debts. I like to tackle the lowest balance first and do what I can to get that one paid down. Then, continue on until all are paid in full.

Hitting the lowest balances first is a method called the Debt Snowball which we’ll talk about more below. It’s a great motivator to get accounts wiped off your credit report and can actually help increase your credit score by clearing revolving debt.

A debt consolidation loan could be your best tool in paying down high-interest debt fast and getting your finances under control. Reduce your debt to just one bill a month and save on interest payments!

Greg Johnson, Club Thrifty

The most common thing we hear from readers is that they are inspired by the fact that we were able to quit our jobs and work at home. They all want to know how we did it and how they can do it themselves. We tell them that there are two main keys to our success:

- Hard work

- Becoming debt free

Hard work is tough to teach. Becoming debt free isn’t. The first step to getting out of debt is managing your money well, and you can’t do that until you learn how to make a budget.

hmmm, starting to see a trend here in the work it takes to really meet your debt goals. It’s tough breaking old spending habits and becoming debt-free. We’re a consumer culture so there’s no lack of temptations to overuse debt but you will be so much happier when you don’t have to worry about the mountain of bills that flood your mailbox.

Jason Cabler, Celebrating Financial Freedom

The most common question I get from readers is how to get out of debt and escape the curse of living paycheck-to-paycheck. I’ve found that behavior change seems to be the number one thing that people are looking for but don’t seem to be able to find a lot of information about as it relates to their finances.

Why Debt is a Serious Issue to Assess

If a responsible person does not pay off his/her debt, the consequences may be severe. Banks and other creditors will charge high interest rates. A judge may order that the debtor be arrested for failure to comply with requirements of the law. People who are in debt should make every effort to reach out to their creditors in order for them to work out a repayment plan.

People accumulate debts for numerous reasons. Some people take out student loans in order to pay for their education and businesses often resort to debt so that they can purchase business equipment or supplies needed to perform business necessities such as constructing buildings or preparing food. People may also become indebted because of situations that are beyond their control. Say for example, a person may become ill and cannot work, but still needs to pay for his own care or sustain his family and his children’s expenses.

Debt is such a serious topic because it has increasingly affected many people in today’s economic downturn. Many families are losing their homes due to mounting debt they cannot pay. Individuals, companies, and even first world countries like the United States can be affected by debt.

The accumulation of debt may make it more difficult for a person or a business to perform basic functions such as taking care of other expenses or saving money. It is normally easier for people to manage their personal finances when there is no debt to think of.

When debts are not paid, it may cause creditors to become very concerned about the possibility of losing money or assets. A creditor who holds a debt might consider taking legal action against a debtor if he/she has performed unsatisfactorily in making payments. Individuals or business owners who have unsettled dues may be forced to file for bankruptcy in order to protect themselves. However, the main reason it is important to tackle this issue before it reaches that point is because of the extreme emotional consequences accrued.

Debt affects people in different ways, hence, solutions are also different and must be as urgent as possible.

Most Common Questions on Debt, Budgeting and Credit

Lance Cothern, Money Manifesto

It can be a bit overwhelming to put together a list of all your debts but it’s the first real step to making a plan. It gets a little easier by getting a copy of your credit report which should have all your debts laid out. Then you need to fill out information like how much you owe, the payment amounts, interest rates and how often you make a payment.

After adding up all the monthly amounts and looking at everything together, you can start building your debt payoff into a budget. If you’ve got extra in your budget then you can put that towards your debt.

If there isn’t much left in your budget (or you aren’t able to make all your minimum payments) at the end of the month, you might want to consider a debt consolidation loan. This is one loan you take out to pay off all your other high-rate debt. Besides reducing stress around making payments to different creditors each month, you can also save on interest payments and make your debt a little more manageable.

One of the most popular uses of Lending Club loans is for debt consolidation, paying off high-interest credit cards with a personal loan. There’s no prepayment penalty and rates start at just 5.9% for borrowers.

loans is for debt consolidation, paying off high-interest credit cards with a personal loan. There’s no prepayment penalty and rates start at just 5.9% for borrowers.

Simple and Secure Personal Loans! Check your rate without hurting your credit score!

Zina Kumok, Debt Free after Three

Readers always ask me, how do I pay off debt and save at the same time? My standard response is that there’s always a way to balance. If you have a 401k and a company match, ALWAYS contribute enough to get the match. These free money retirement investing plans should never be passed up.

If you don’t have a company match, I recommend comparing the interest rate you’re paying on your debt compared to what you could earn in an individual retirement account (IRA).

If you have a high interest rate, focus on paying off your debt and maybe only set aside 5% of your income toward retirement (if you don’t have at least $1,000 in your emergency fund). If your interest rate is low, then try to contribute 10% of your income toward retirement. There is always a way to do both.

I love Zina’s response. I see so many people recommending that you completely pay off debt before even thinking about saving and investing. It’s a nice goal to have but let’s be realistic…shopping is just too much fun!

You may never completely ditch your debt. Waiting until you pay off debt completely might mean that you retire with little debt but absolutely nothing put aside to live on. A study by Bankrate found that almost a third (29%) of Americans 65 years or older had as much credit card debt as their savings.

Pay off your high-interest debts but get a little balance in your financial life and put some money to savings.

Gary Weiner, Super Saving Tips

We get the question, “How can I improve my credit score?” all the time and have a few key points that we share with readers. Your credit score is mainly based on the percentage of your credit you use (utilization) and the promptness of your payments.

- Too much usage hurts, late payments kill.

- Only spend what you need to and pay on time.

One way of improving your credit utilization is to ask for an increase to your credit line from the issuer. If you have $2,000 borrowed on a credit line of $3,000 then it looks like you’re almost tapped out with a 66% utilization. Get your credit increased to $5,000 and your utilization drops to 40%.

This doesn’t mean you rush out to spend more of your new credit and is only a minor fix to the bigger problem of paying down debt, but it does help to tackle one of the factors that can hurt your credit score.

Common Questions about Student Loan Debt

Student loan debt is becoming the trillion-dollar problem in America, literally. High interest rates on student debt since the financial crisis are causing young Americans to put off major life milestones like buying a house or even getting married.

Robert Farrington, The College Investor

The most common question I get is about student loan debt and consolidating with some of the offers that get spammed out to graduates. Readers email me questions like, “Is XYZ company a scam? Should I pay $599 to get my student loans forgiven?”

The simple answer is NO, don’t pay these companies. While some are scams, most are legitimate companies offering a service you simply don’t need to pay for. Anything to do with Federal student loan debt can be done for FREE! Simply login to your account at StudentLoans.gov and find consolidation options, repayment options, and forgiveness programs.

Jeffrey Trull, Student Loan Hero

Readers often want to know if refinancing their student loans is a good idea. It depends as there are tradeoffs if you choose to refinance. By refinancing your federal student loans, you’ll give up flexible repayment options, like Pay-as-You-Earn and Income-Based Repayment. You also won’t have access to the same deferment and forbearance options.

However, if you’re confident you’ll be able to repay your student loans without needing these federal student loan repayment options, the savings on interest by refinancing can be significant. While there’s some risk involved by refinancing student loans, choosing to do so can help you save money and pay off your loans faster.

Natalie Bacon, Financegirl

The standard inquiry I get comes from hopeless readers who are swimming in massive student loan debt. Usually it’s young professional women asking what they should do and how to move forward with their $200k+ debt (or their spouse’s debt).

I don’t have a standard response. My response is always specifically tailored to the person. I give a unique reply because, so far, their money issues are never actually about student loans — their money issues are about themselves. They have fear and feel powerless. Most of my readers need help changing their mindset as it relates to money, and only then can they tackle their debt. This supports the underlying value that I believe in, which is “money is a reflection of you”. This is why I write about finance andintentional living.

Joseph Hogue, PeerFinance101

The most common question about debt I get here on the blog is how to decide what debt to pay off first. There are a few ways you can approach it depending on what your goals are for paying down debt.

- You can rank your debt by interest rate, paying off the highest rates first. This is the most popular method and referred to as the Debt Avalanche. The idea is that paying off your high-rate debts first saves you on interest payments.

- You can also rank your debt by size, paying off the smallest debts first. This method is called the Debt Snowball because, like a snowball rolling down a hill, the accounts on which you pay extra start small but get bigger. The benefit to this method is that it feels great to see accounts get paid off and drop from your list. The motivation can really help you keep to your plan.

- The final method revolves around credit score factors and the difference between good debt and bad debt. Putting revolving credit (credit cards and other loans that don’t have a fixed payment or payoff date) high on your list to pay off will help increase your credit score. With these, include other toxic debt like payday loans and high-interest auto dealer loans.

Did we answer a few questions you’ve had on debt? One of the opportunities in these roundup posts is that it helps you find some great resources through some of the best minds in personal finance. Share your debt question below and I’ll check it out with some of the experts.

Read the Entire Debt Series